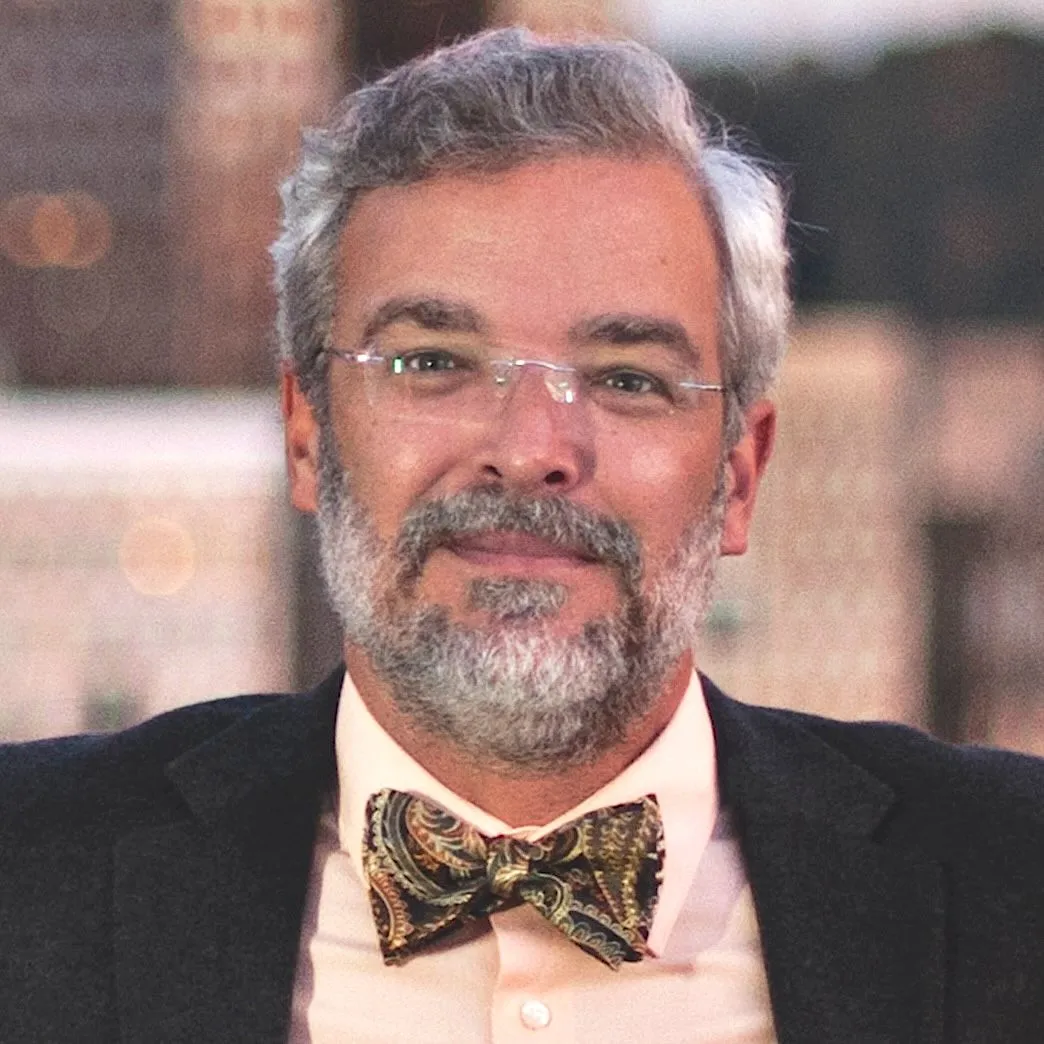

Bank of Pittsburgh

Founded in 1810, the second bank established in Pittsburgh lasted for more than a century. It weathered several 19th century financial panics, and boasted that it never once refused to pay a depositor in gold or coins if requested, rather than banknotes. But the Great Depression finally ended its run, and the Bank of Pittsburgh closed in 1931.

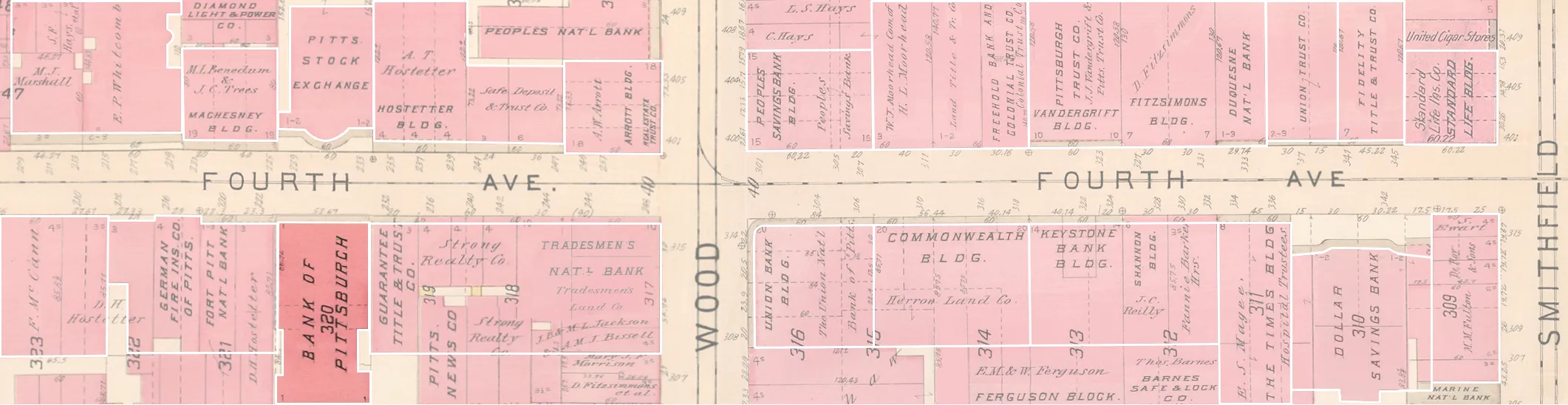

The celebrated New York architect and skyscraper pioneer George Post designed its 1896 Neoclassical temple, a design he recycled a few years later for the New York Stock Exchange. Upon entering the bank, visitors could gaze up at a mural of Pittsburgh on a throne offering her iron and steel to the world.

After the bank closed, the building was used by government officials handling the liquidation of other failed banks. It was sold in 1942 and torn down to make way for parking spaces, and eventually a garage. Preservationists persuaded the owner to leave the facade standing until another use could be found for the granite columns. They now surround a statue of Thomas Jefferson at a cemetery in Pleasant Hills.

Also in the footprint of the parking garage was Farmers & Mechanics Bank, established in 1813 but liquidated five years later in the wake of Pittsburgh's first bank robbery. Thieves stole the key from a night watchman's post and fled in a boat after cleaning out the safe, triggering a low-speed Ohio River chase.

William Wilkins

The first president of the Bank of Pittsburgh was an attorney and younger brother of the president of the city's first bank, which was a branch of the Philadelphia-based Bank of Pennsylvania. Wilkins had recently returned to Pittsburgh from Kentucky, where he sought refuge with another brother after being censured by the bar for participating in a fatal duel in Oakland as "second" to one of the combatants.

Running a bank helped to repair Wilkins's public image, and he went on to be president of city council, then a judge, senator, ambassador to Russia, and secretary of war under President John Tyler. The borough of Wilkinsburg is named after his older brother John — the other bank president — who was also a Revolutionary War veteran.

Harrison Nesbit

The last president of the Bank of Pittsburgh was a federal banking inspector before he joined the financial institution in 1909. A year later, at the age of 35, Nesbit was named president. The new executive welcomed visitors to his bank's centennial celebration that year, making sure every woman got a carnation and every man a cigar.

By 1930, Nesbit was more than a million dollars in debt. His wife took a $200,000 loan from his bank to repay creditors, and the following spring the board of directors put him on a six-month leave. The Bank of Pittsburgh failed that September; a month later, Nesbit was riding in a car driven by his teenage daughter when it crashed into a parked truck, killing him.

A million-dollar life insurance policy the bank carried on its president went toward paying back depositors. The bank's receivers sued Nesbit's estate to seize a $750,000 trust fund he had fraudulently set up while broke. They also went after the board of directors for letting his wife take that loan.